The current Basel 3 regime requires firms with market risk internal model approval to conduct daily backtesting at the approval level. Under FRTB this will still occur with some modifications mainly to bring it down to an individual desk but the firm will also have to perform tests on the precision of its market risk figures. This is a new Attribution Test. Before the financial crisis banks could make simple add-on adjustments to their VaR for risks that they admitted their models valued poorly without losing the major benefits from the approval. Now valuation and risk computation weaknesses will need to be managed effectively to gain and retain internal model approval.

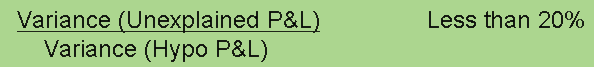

A firm has to use its official risk parameters with the actual market move to create a Theoretical P&L. This is then compared to the Hypothetical P&L which is the actual P&L when only considering the opening positions and ignoring any trades done during the trading day. The difference is the Unexplained P&L as you would like to think your official risk gives a strong indication of the P&L market moves will create. On a monthly basis the firm has to compute the following figures and ensure that they are within the ranges set;

and

In plain English the first is trying to detect any bias in the unexplained P&L. If it’s just random noise then its mean should be zero (although twenty trading days is a short period to see such mean reversion). The second is asking, “how noisy is my unexplained in the context of the volatility or stability in the main book P&L?” If the main book is pretty stable then one would not expect a very unstable unexplained element.

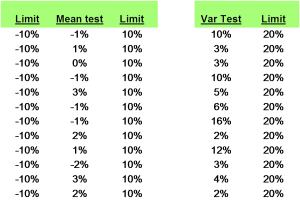

If either of these fails four times in a twelve month period the model approval is lost for the desk. To regain the approval the desk needs to pass the test for the next twelve months. There has been quite a lot of comment recently from the industry that these tests are too strict and that a firm with many desks will constantly have some failing the test and getting put back to the standard rules with an increase in the capital requirement. As a simple exercise I created a portfolio with an S&P 500 future in it and used the S&P 500 index as my risk measure for my theoretical P&L for the year to 30 June 2017. There’s a small basis between the index and the future and my attribution test results were as follows;

Whilst the future is more liquid than the index it has to deal with expiries but I think this shows that standard linear portfolios should be able to meet the standard. Where it will become more challenging will be in the area of non-linear products such as options. For example if the risk measure only captures the spot Vega then it will miss the impact of any skew or smile in the volatility surface. It may also highlight data quality issues. Some institutions use exchange traded marks for their pricing even where the prices may be stale as the option in question is not liquid. This can create P&L noise that the risk measure will struggle to match. A standard solution to this would be to use a model based price based on more up to date market inputs.

Out of curiosity I modified the above test to assume that the actual and theo P&L were computed daily in EUR using a daily USD/EUR exchange rate. But I simply converted my Theo USD P&L into EUR at the monthly average of the USD/EUR rate. Both tests failed in almost every month as effectively I’ve introduced a spot FX position into the book but captured no risk information for my theo P&L. Product Control functions use P&L explain tests to produce risk driven analytic backup to market commentary. The residual unexplained P&L is invariably attributed to higher and cross-terms in the risk that their explain does not compute. These tests set some quantitative hurdles for firms to meet in this area.

Most banks serious about retaining their model approval should be well advanced by now in performing these tests on their production portfolios to see how well their risk management Theo P&L stands up. The constituents of a desk will matter a lot. A standalone option book may struggle to meet the test but if it is combined with large linear books then the overall Hypo P&L should be larger. Obviously, firms should be ready to justify their rationale for including books. Less controversially, practical data issues in closing marks can be identified now and action taken to improve the quality of the marking.