Cleanups and investigations are a fact of life for large financial organisations. Making sure that every single transaction’s details and balances are correct and regularly proven to be so is not a glamorous task. It’s unlikely to be a quick stepping stone to the executive office (although many old-school banks used to ensure that their management talent got exposed to all the nuts and bolts of the organisation1). And despite CEO’s protestations that they are on top of it all things slip or get missed. Banks’ operational risk management systems have improved massively over the last few decades and new businesses are entered much more cautiously than in the past. But with so many processes and controls offshored and outsourced getting below the corporate MIS can be a challenge. Cleanups and investigations take many forms the most common being;

- Unreconciled GL balances (FX is a recurrent issue!)

- Gaps between incurred funding costs and allocated funding charges

- Detailed product record maintenance failures (dividends, coupons, WHT, stamp duty, mortgage details)

The reasons for the creation of such problems are varied and the subject of a much longer study.

But they are projects and they have characteristics which are strikingly different from the normal business/ systems/ product development projects banks tend to run;

- Planning Experience – It’s normal to find project managers and participants with a lot of relevant experience from previous projects to create similar systems or products. The number of full-time clean-up/ investigators is small and mostly only found in fraud teams. This means that scoping, sizing and planning the project is subject to much more uncertainty due to the lack of experience. Senior management regularly forget the inherent higher levels of uncertainty these projects have.

- Environment Stabilisation – When you develop a new product you do not have to implement changes to your procedures to cope with it until you go live. But with a cleanup it’s more like a leaking water pipe in the penthouse suite. You must stop the leak to contain the damage and this is more important initially than the actual cleanup. So the causes of the problem need to be addressed and fixed, otherwise the actual cleanup is working on an increasing problem, not a static one. There are rare cases where the problem is static such as residual balances from a decommissioned system but generally stemming the flood is the first job.

- Data Gaps – Generally when a development project needs data that does not exist (such an obscure time series for a VaR model) it will either attempt to manufacture the data from proxies and simulations or take a different path. In a cleanup the data may truly be lost, i.e. the journals in the ledger no longer have any supporting documentation. The project has to continue regardless, it cannot choose to de-scope this area.

But they also have much in common with development projects;

- Scoping and Planning are still important, ideally with more contingency to compensate for the higher uncertainty. It’s very common for there to have been previous attempts to clean up the area that have failed to make the necessary progress. Learn from them as they probably lacked the resources and priority needed. Quote them when your plan is challenged as too large or expensive.

- Resourcing all the skills is critical and it can also lead to resource requirements that cannot be met (the C++ and Android developer who’s fluent in English, Korean and Mandarin is matched by the dividend accountant familiar with Cumulus, Sophis and GMIS!). Think of ways to combine different skills you need.

Equally, budget constraints may mean that senior management want to solve the problem without actually dedicating any resources to it and it’s therefore important to communicate that part-time projects rarely proceed as quickly as those with dedicated full-time resources. - Cost – Benefits can also be found in say becoming able to amass the evidence to support a WHT refund claim, or to stop the central loss taking caused by a funding gap.

- Back Seat Drivers abound, just as marketers and traders who’ve never cut a line of code will explain how easy a real-time web portal is to construct the same “experts” will contend it’s easy to rebuild ten years of fudged FX rec’s with the same credibility.

What’s the Cost?

Senior management generally only want to know a few things about a cleanup;

- Does it have a public impact (lawsuits, regulatory fines, customer compensation?)

- By when will it be fixed, do any activities need to be restricted?

- What will be the P&L impact and cost?

- Any hero’s or villains in the story?

The loss estimate should collate;

- Any potential un-managed market exposures. The P&L will be proportionate to the size and time period they persisted.

- Any debit balances which may have to be written off.

- Any fines et cetera.

That’s not to say you will not get lucky and find a profit (I did, once:-). As traders are generally more likely to challenge a loss or a lower profit than an excess profit this adds a bias into the control environment where an overstated profit later becomes exposed in a cleanup and the reversal is a loss. Unfortunately management do not usually distinguish between losses due to the reversal of previously over reported profits and real economic losses like market risk losses and and credit write offs due to lack of necessary detail (mortgage foreclosures were challenged in the credit crunch when it became clear that firms did not have the correct supporting records for the debts they had bought to effect recovery).

The Project Approach

- Scope and measure the size of the problem particularly metrics to show; a) The impact of the stabilisation and b) the progress on the investigation.

- Determine and acquire the resources you will need to complete the project.

- Establish a reporting framework, one very effective method used is to weekly report four items;

- What you planned to accomplish in the week.

- The actual progress made, including any information about P&L impact.

- What you plan to accomplish in the coming week.

- Any issues or obstacles you have.

The format does put the team under pressure to report progress each week but it adds the discipline of setting realistic targets for the following week, and also not letting the team have an easy ride as the target is public. Equally, if you are dependent on another group to contribute data or expert time then it can highlight the issue although ideally the other group would have contributed resources to the project.

Item Difficulty Curve

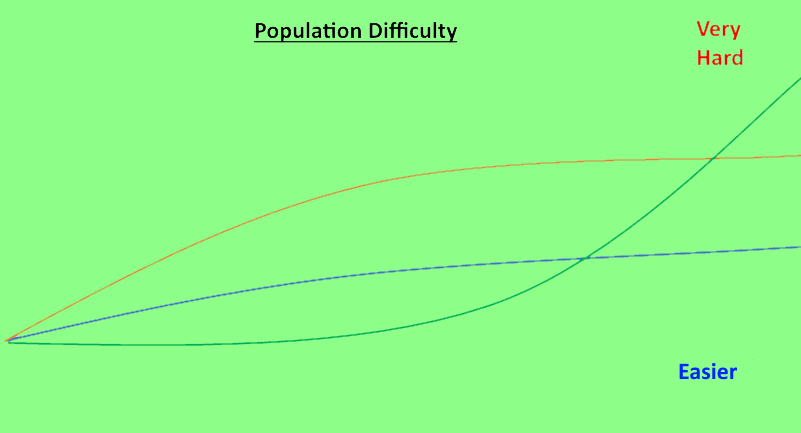

Once characteristic of a cleanup is that the items being investigated are usually not connected, although there may be many that are similar. Once one of the types has been identified and its resolution clear it can then be applied to all the items of this nature. So as the project resolves some of the items good progress can be made across the more homogeneous part of the population. However, it is in the nature of this is that the remaining items will be more challenging to solve and it is very hard to estimate exactly how difficult it will be to understand and resolve them.

You should try to make this clear in your progress communication that the current item clearance progress rate may not be sustainable. Equally, the team will be gaining experience in the area to counteract the increasing difficulty.

The Most Difficult Items

It’s hard to advise on these and it’s very likely that there is a lot data missing. The other element I’ve seen often is fundamental assumptions about the nature of the item the are incorrect and lead to the wrong approach. As a simple example, everyone might have told you the items in an account are bond coupons that have been mis-posted, thus you go looking for coupon receipts and bond positions which are due coupons with no success. The critical questions are really, “why do people think they are coupons?” and “what else might they be?”. Ideally, ask these early on rather than after weeks of futile and profitless enquiry.

Another assumption you need to guard against is that reasonable normal processes and facilities exist. I’ve seen very large banks with accounting systems where finding the other side of a posting (the debit to match a credit) is incredibly difficult even though it’s often the key data to understanding accounting that has no documentation. Treat it all as part of the experience. One learns different things on cleanups.

The Living Dead

In cleaning up accounts a certain amount of netting off of postings and balances is inevitable. One consequence of this is that at some later time someone may come along and claim (with backup) one of the credits you’ve used and suddenly the debit you’d buried and reported resolved springs back into life as a problem. The best advice I can give is to finish the project and move on before this occurs.

Afterwards

A cleanup is a great opportunity to learn how an area works in detail. And more importantly identify how is should work. You are ideally placed to implement and manage the new and improved area. Also the project is an opportunity to show senior management your skills. I’ve seen good cleanup managers get promoted to run the area properly.

1 A previous chairman of JP Morgan Sir Denis Weatherstone on a trip to London office ignored his entourage of MDs to stop and chat to his old colleagues from his stint in the London Post Room. In a less electronic age the Post Room was the nerve centre of a business’s communications.

© Greg Stevens October 2017